Dream4k Television Service first emerged in 2019, providing top-end resolution TV experience across all devices in Europe to enhance the ordinary residence’s TV experience. Data gathered from media platforms suggests Dream4k is currently hitting the market hard with its exciting services. Besides entertainment seekers from subscription platforms, Dream4k offers a chance for viewers around Europe to catch up on over 140 HD channels. Several other video platforms showcase exciting TV and video content to European viewers, positioning Dream4k Television Service among the top one-stop TV entertainment destinations. Current data from national statistics in ethnic groups as potential target reach states that Dream4k Television Service could potentially attract viewers from various nations in Europe, with the highest number of viewers housed in Austria, making the potential reach over 2 million people, while Germany could potentially hold over 1 million viewers.

Regarding how people now consume media, the advance and uptake of internet platforms and services play a role in this respect. Viewers mostly prefer to consume high-resolution content on their television screens more than any other devices, which is the result obtained from the connection in 2019. The viewers mostly interested in these services belong to the age group of 25 to 85 years. The data was also found to be consistent with the age ranges as seen in Austria and Germany. High-resolution content is easier to take and serve, but people are also driving towards quality and more content, and that is a gap Dream4k service fulfills by providing complete HD channels that cover news, sports, documentaries, catch-up services from some of the best TV channels, and movies, making the service a complete offer to the market from a TV station’s perspective.

In the early days of television, programming was distributed using analog broadcast technology. The first regular TV services were launched in experimental shortwave radio in the 1920s to early 1930s. In the early days of broadcast television, signals were often sent out from sites where the terrain would provide good transmission and reception of signals. The geographical location and the size of the antennas used at the transmitter and the receiver also determined the quality of broadcasting. Starting in the 1930s, European countries integrated developing ideas to create a pan-European service. These developments continued and accelerated after the end of the Second World War and included a demand for European cultural identity and the potential for propaganda uses, among other things.

In the 1950s, the European Broadcasting Union and its then main technical committee sponsored the development of an international standard for a 625-line television system. This became what was known as the European 625-line television system. Starting in the late 20th and early 21st century, part of the trans-European broadcasting network has modernized and converted from analog to digital technology. Television technology in use now includes analog, digital, high definition, and, specifically in the cases of consumers with advanced television sets and specific broadcast services, ultra-high-definition television, with a generally agreed upon minimum number of lines being 4,000, known as Quad HDTV and also known as ‘4k.’ From the 1950s, there has been an increased role for government regulations related to broadcast television content. In the first part of the 21st century, private technology companies have been producing the majority of television hardware and have started launching their own broadcasting services. Partly through public policy and partly through entrepreneur-led developments, the television market has recently seen several major transitions in the technologies used.

The IPTV industry, like most other video streaming businesses, has been rife with change over the last decade. The adoption of super-fast fibre to the home solutions – increasingly made available to people around Europe with heavily subsidised pricing – has enabled competition from newer technologies such as Dream4k. With these increased internet bandwidths, 4K TV is now possible to receive via IPTV boxes over the internet, giving the picture quality comparisons to match satellite services, attractive to the most demanding of customers. Super-fast broadband streaming services are expected to take over from traditional satellite setups in the years to come (Randal Ray, 2014).

Further technological advancements have seen more and more corporations integrate services into a cloud type shape on the internet – video-on-demand is now becoming popular with IPTV providers with over 1000 titles; whilst virtual personal recorders are enabled by cloud technology allowing users to record multiple streams at once. Alongside this, large data companies now see artificial intelligence as the future for customer service inquiries within IPTV; a chatbot that understands context and learns from your previous message inquiries is now becoming available across multiple consumer services.

Finally, with video streaming technology bettering year on year, there has been a large push towards H.265 whilst still in its infancy due to internet compatibility issues across older and less powerful internet connection boxes within Europe, the codec provides up to 60% better compression than H.264 – or a superior picture at the same low bandwidth of H.264. As the codec becomes more widespread with new IPTV boxes, VOD titles, and streaming systems, picture quality is likely to heavily improve for the end user, synchronizing with the recent picture quality increase from Dream4k. At the same time, the industry has seen a large increase in user interface and streaming box experience; many of the most popular box manufacturers in Europe often don’t specialize in this field – a new box at a similar price-point from Dream4k gave significant user interface improvements and security protection against popular hacking services. Quality OF SERVICE control of an IPTV service is essential in a saturated market; identity theft, loss of service, and data retention have become a big issue with many online-based streaming services in the last decade. In an increasingly competitive market with more aggressive consolidation, it is clear that better quality of service is necessary to stay above opponents; low latency streaming, adaptive streaming methods for VOD, and most newly DreamK offers a unique IP that solely connects to the user’s home network and never shares the user’s IP with any other user, eliminating the connection saturation hacking vulnerability rampant across many internet streaming services has been built into popular boxes and is likely to be a new selling point in the years to come.

At EURO STREAM IPTV, we want to ensure we cover all your favorite devices

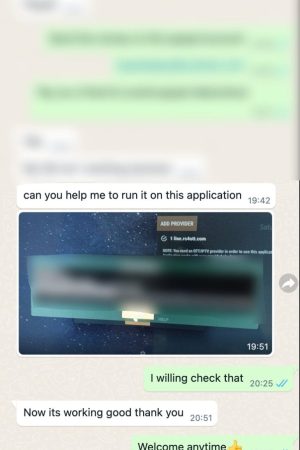

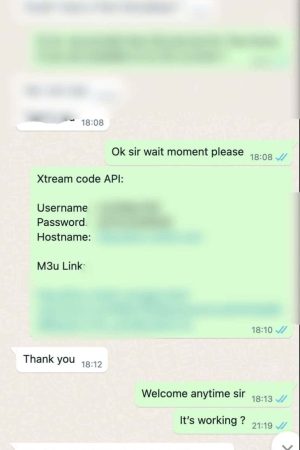

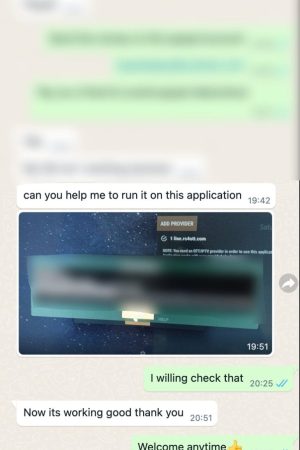

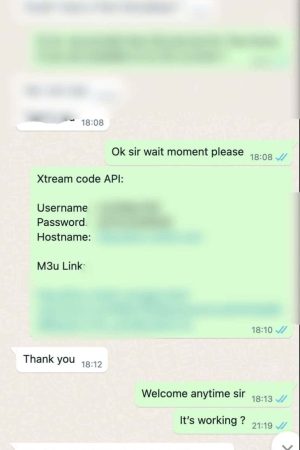

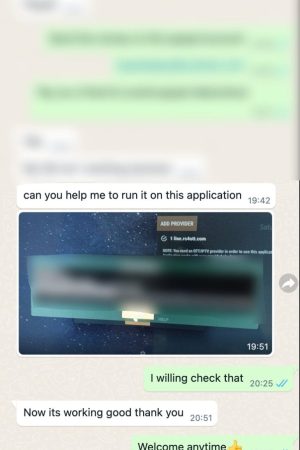

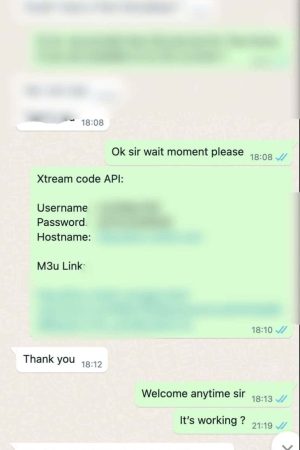

Experience hassle-free IPTV Smarters with our responsive 24/7 customer support. We're always available to ensure you enjoy seamless streaming.

Access premium channels and exclusive events not available anywhere else. Enjoy unique content and entertainment with our IPTV service.

You can easily set up and install your IPTV subscription on your favorite device. If you need assistance, our customer support is here to help you every step of the way.

According to our surveys, there are a number of major players in Europe providing high-quality television services. Traditional cable operators provide television services to more than two-thirds of the surveyed households. Usually, these traditional cable operators also offer internet services to their customers. In addition, several subscription-based streaming platforms for on-demand television streaming services are available in the three survey countries. Recently, the streaming services have become more popular in Europe due to the possibility of viewing television shows at a convenient time and at the customers’ own pace. In fact, our results indicate that streaming services are currently viewed as equally important as traditional television cable subscriptions. Our survey showed that, in general, the number of subscribers to streaming services in Europe is slightly less than the number of subscribers to traditional cable operators.

The absolute majority of traditional cable operator subscribers in Switzerland and Spain are between 25 and 50 years old, while most of the streaming subscribers in Germany are under 25 years old. Education levels and housing structures differentiate television viewers in the three countries. The subscribers to the three subscription services state that having children is the factor most widely related to the decision to subscribe to such services. Television viewers from Switzerland, however, decide to subscribe to online television services based on their availability to watch their favorite television series at any time. This is the main reason for subscribing to online television networks in Switzerland. In contrast, German subscribers argue that television network services help them stay away from traditional television advertising. Additionally, a portion of German adults also mention the availability of an attractive television project as an important reason for subscribing to online television services. The primary variables that predict the acceptance and preference for advanced television usage in Switzerland, Germany, and Spain are income, experience, and households with children under 12 years of age.

Dream4K Television allows viewers to enjoy the content in 4K resolution, which is currently the best available technology on the market, delivering images four times sharper than the standard high-definition 1080p resolution. Extraordinary picture quality combined with high dynamic range (HDR) allows for the best possible and most immersive experience for customers. Live broadcasts are delivered using H.265 streams, which is the latest compression technology that enables a significant boost in the available channels in 4K resolution, allowing viewers to enjoy their favorite content in extraordinary quality. Dream4K TV introduces interactive content experiences; the features of the service enable viewers to explore additional information regarding a program they are watching in picture-in-picture mode and vote to influence the storyline of a specific 4K movie. Huge library of content in 4K resolution. Exclusive 4K TV series, movies, and documentaries that are spread across all content categories. In-house 4K production available as Dream4K’s exclusive. The subscription also includes Dreambox TV channels, which can be watched as an HD up-convert into 4K, making our subscription service unique. Top country and languages – To cater to every possible audience, the service provides the option to change the default language on the user interfaces. User-friendly interface – At Dream4K TV, we keenly believe in designing a service that has a great user experience and an easy-to-use interface. As a result, viewers can easily explore content by going through our categories and get the best experience possible. On top, you also get the option to pick the plan that suits you best. Advanced streaming technology – By leveraging next-gen streaming tech, Dream4K TV subscribers can now enjoy high-quality subscription streams from a remote area as well. In the future iteration, subscribers would also be allowed to watch 4K IPTV without paying for a frequently renewed IP.

A significant, pressing issue centering on the introduction of Dream4k Television into European markets is facing a variety of external challenges on all fronts from the regulatory and general consumer perspectives. Existing competitors in traditional broadcast and new streaming service providers internationally include several deeply established competitors across the continent. Aspects of this are explored in later sections of our report. An additional challenge is to introduce an international streaming service with its associated diverse legal, regulatory, and licensing restrictions. One possible market entry approach is to consider partnerships with local content producers in different markets to gain knowledge, enable market entry, and introduce strong established national content to markets. However, there are a variety of consumer and market trends to take encouragement from, as well as potential opportunities. Across Europe, consumers are increasingly interested in high-quality content. This is underpinned by a global increase in wealth, increasing middle classes in developing markets, and consumers engaging more with technology, which is also driving increased demand for HD video content trade globally. In this market sector, it is the highly valuable cohort of high-turnover, low-regard for cost audiences that Dream4k TV is aimed at. Further, there is evidence to suggest that Dream4k might be reaching price-conscious “cord-cutters” globally who are willing to forego cable television service and the associated television packages in favor of paid content on-demand basis. Lastly, a regional focus on penetration of Dream4k TV in Eastern Europe can help mitigate some of the service adoption challenges in more established television markets such as the Baltic states.

Several end-user surveys and studies provide some guidance as to the adoption rate. It was found that approximately 64% of consumers say that they watched 4K content “always” or “most of the time” when given the opportunity. There is a very strong correlation between user satisfaction and the viewing of high-quality content. As for transforming those studies into a unique adoption (subscription) curve for a DTH 4K service, little guidance is offered. The TV demographics for watching 4K tend to be younger and more technologically eager to be among the first to adopt a new TV technology. At the same time, older audiences report less brightness and a darker picture on account of the 4K technology that makes content harder to see.

Amateurs of high-quality video and audio are normally between 18 and 34 years old, and early adopters of new gadgets are men, most of them from 18 to 24 years of age. Teens and adults under 35 years of age usually start off with hip new gadgets while older adults typically follow in their footsteps because they are not as technologically adventurous or as financially capable.

User timeline reports are the only statistical insight that we can offer here. It is important to note that the ratio of peak time directly parallels the number of 4K subscribers ranging from a low of 3.62% to a high of 3.84%. Data suggest that as more programs become available to the target audience, roughly 3.8% of them, both current and future customers, source their video content between 6 p.m. and 11 p.m. Over a five-month period, a target marketing campaign focused on elderly folks (median age 75-84), because the marketing survey clearly indicated that they were most interested in the service. These efforts resulted in a 1.25% adoption of the general cable plant subscriber, with 14.3% taking the DVR/HD/4K capability. The campaign yielded a significant number of new subscribers with a combined demographic most interested in the 4K project service. The marketing error rate was probably no more than 7%. Three were not happy with the technician and three had no interest in DTH television at all. No comments appear on being unhappy, so we do not know if it stems from the quality of the interaction or the TV content available. It may be that the target audience was not that interested in how the service was delivered but more in the type and quality of TV services that would be made available with the new technology.

Section 7: Regulatory Framework and Policies Impacting Dream4k Television Service

In Europe, a number of international regulations and directives impact the broadcasting sector. International agreements on frequency use and satellite broadcasting coherence can be relevant for some aspects of a service provided via direct satellite distribution, as is the case of Dream4k Television service. Other international regulations, such as content access and usage restrictions, are nonetheless relevant for the regulatory description of the nature of the service provision and of licensing needs. The regulatory environment is based on public policy and consumer protection considerations, as well as on competition policy goals. The Dream4k Television Service, being a commercial offer of the BBUS commercial company in all member states of the EU, requires a specific orchestra of regulations that can differ among countries, creating challenges for a pan-European operation.

Regulations cover programming, funding, licensing, etc. Regulations also have to take changes in TV consumption into account, with a shift in the main access mode from non-digital to a mixture of digital O&O and unlicensed triple-play offerings for some, and principally to unlicensed OTT SVOD streaming over unlicensed broadband for the rest of the users. As streaming could be considered an OTT application and not a broadcast one, the service is not necessarily covered by mandatory local content, must-carry, and/or other access obligations. The consumer/user data protection requirements have become a key aspect of the service regulation. Telemedia commercial video offers compete in some countries and regions, as announced very early, under some conditions, by the application of a very or total must-carry obligation of digital terrestrial TV, FTTH or FTTB O&O infrastructure quadruple-play operator offerings’ channels—offerings that are not part of a B2B2C by third parties’ international contracts. These non-shared line offerings happening on the alternative or on the new local last-mile infrastructure of the BBUS operators become shared line services only as extensions or, in some areas, are run on the common-line infrastructure of the incumbents.

The television market in Europe, projected to be worth €99.5 billion in 2022, is characterized by fierce competition. In general, for the purpose of this analysis, two main categories of competitors can be identified. First, there are the main broadcasters in Europe, involved primarily in traditional television broadcasting. The second category consists of new streaming service providers. Among the major players, Amazon Prime Video and Netflix have the highest market share per subscription. This is probably due to their profitable pricing models, as both providers have a higher monthly revenue per user figure than the average. Another important element is the exclusive content, which has helped set them up as major players in the sector. The major social TV broadcasters in the European sector use their own platforms, and when it comes to ways to follow a match or a TV program, the respective percentages, for instance, events in Germany offer an interesting snapshot of the situation. 59% prefer watching live matches due to their availability, while 35% prefer watching on demand due to its availability. The rest of them prefer watching it over-the-air, which shows us consumer behavior in the market. Last year also saw a rise in M&A activity in the sector, with the consolidation of major players likely having a snowball effect.

The emergence of these new streaming technologies has led to the entry into the sector of a series of start-ups that are trying to exploit users’ preference for new technologies. The crucial point to understand is the competitive situation in order to acquire a perfect grasp of market trends and, based on the forecasts made, to offer recommendations for the European plan. In Germany and also in other European countries, the online streaming industry is barely developing. This is a very big chance because many can be catered to by the startup, and the streaming industry is only in its beginning stage. Compliance is, however, very imperative, and the company must remain legal and respect the rights of all manufacturers. Native Germans will perform far more productively in a working environment than average foreigners because they will have a lot of knowledge of the operations of the regional streaming industry and know how to acquire business effectively. With the jack-of-all-trades method, as everyone else is already performing straight, the firm cannot distinguish itself.

Fundamental to Dream4k Television is the fact that we have developed, and continue to develop, leading-edge capabilities in point-to-multipoint, best quality of service, unbuffered, high-definition streaming. A range of technological advances have come together to make the Dream4k Television solution not only possible, but practical at reduced operating costs. Dream4k has achieved four to six times the reduction in bandwidth of significant compression algorithms. Other digital terrestrial television advancements include significantly increased capability to store and serve persistent video content from a digital video recorder server, a significant enlargement of an already excessive exercise in video-on-demand technology advancement to involve the best of other key DVR areas plus new and innovative technological progress; and the piloting of technology that enables increased viewing capacity within the European market area.

New industry compression algorithms and uniquely efficient bandwidth utilization have cut broadcast costs for satellite and cable drastically. We are now the first company to dramatically cut streaming delivery costs by reducing the number of streaming servers and streaming delivery rates by 200-600% for original content. Nothing else is comparable in the world today. Our platform supports rapid new innovations in addressable advertising, e-commerce insertions, and smart end-user features using IP and smart device capabilities. This seamless, high quality-of-service transport of the content is fundamental in getting the best viewing experience out of the equipment. Just because a user can download a video, save it for future use, and view it at their convenience on a device, doesn’t necessarily mean they will. Streaming ensures that the video is watched to completion before the user can return to their previous activity. This is why streaming is so crucial to ensure good take-up rates. The Dream4k Television Service shows that Dream4k is also now the world leader in other digital television streaming technologies including digital terrestrial television streaming, satellite streaming, and video-on-demand streaming. Video can be viewed streaming or downloaded and played with the Dream4k European TV app, which by using the features of the phone allows for augmented reality and virtual reality. Allow users to view the next match goal in 360-degree video before the ball even hits the net from their own home for game console users. As well as being known for great viewership, those other technologies are all secure and compressed better than most other services. The Dream4k Television is also on Windows Desktop, Smart TV, and Android TV. If you’d think we’re that good, we’d like to remind you that we built the transmission infrastructure that serves our app. The Dream4k head-end is built from the ground up to always be above industry standards. In fact, we have a full 20% more transmission head-end than needed. We have a direct loss of three full transmission servers and receive servers and still have full functionality end-to-end to prevent any streaming server outages. We have a robust cloud technology storage via Dream TX.

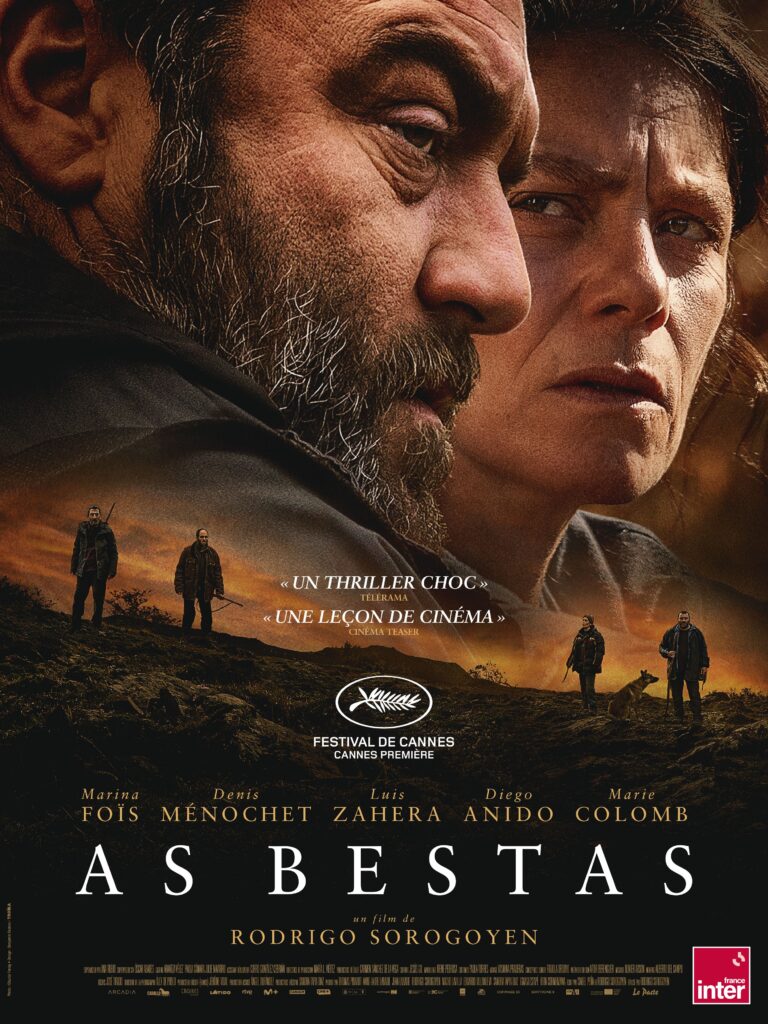

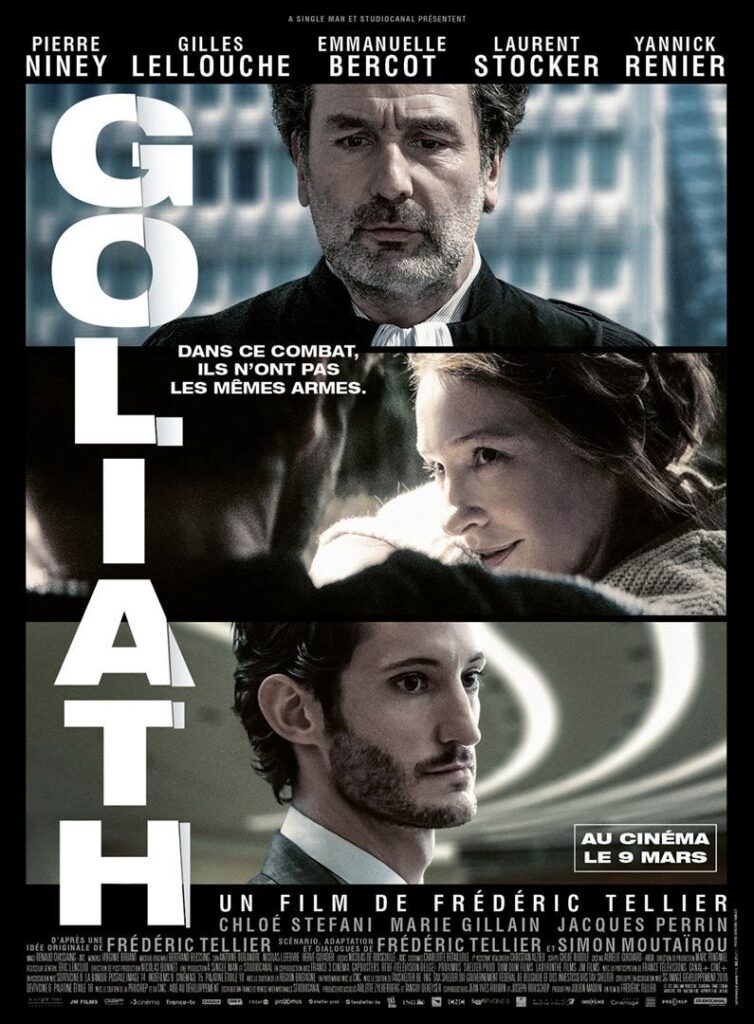

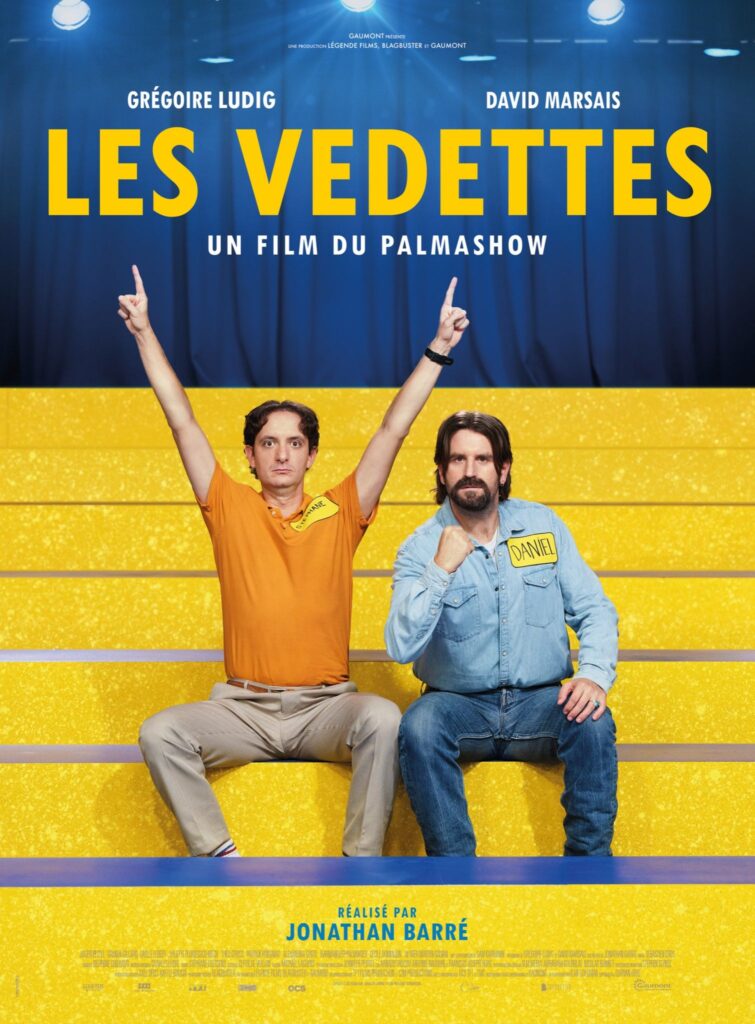

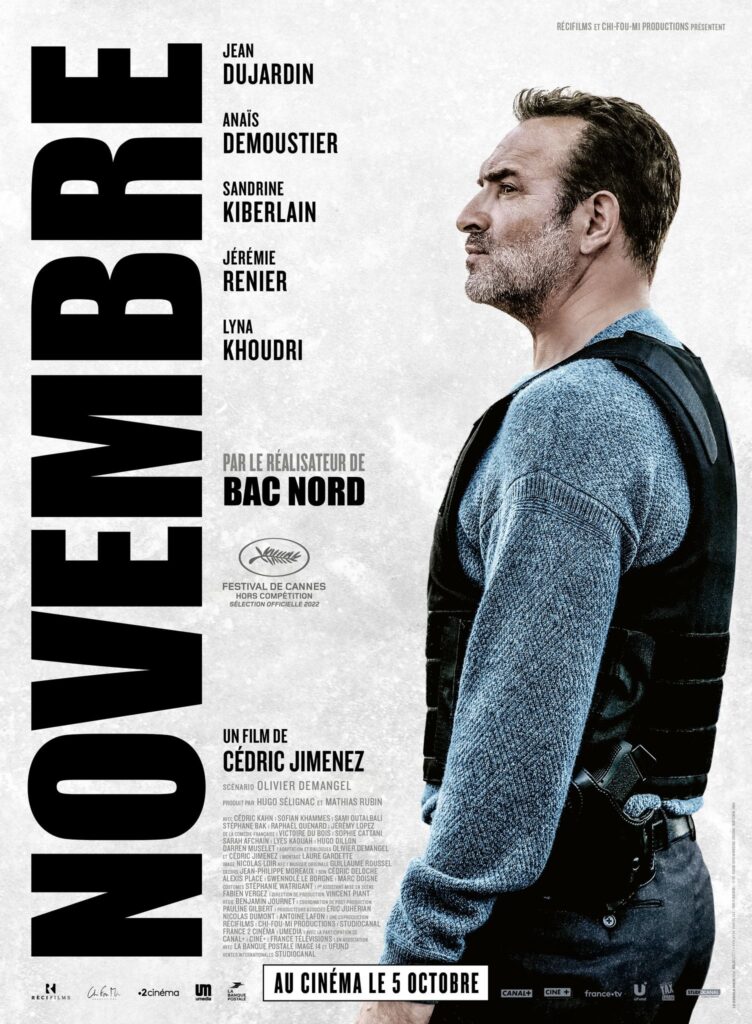

Dream4k provides a catalog on its platform that is not available on other Subscription Video on Demand services in Europe. The company has had a steadfast belief in creating unique, original, and exclusive content that serves to differentiate Dream4k in a crowded market. Dream4k’s content team has developed strategies to ensure this diverse content output, including working with established and emerging arthouse film directors from all over the world, creating art film documentaries in collaboration with art foundations, sourcing anime, and working with an elite set of individual artists and illustrators with whom there is a growing global fan base.

Dream4k’s curated approach to content takes into account the tastes, viewing habits, and geographic spread of its rapidly expanding customer base across Europe. The company streams all its content via the “Dream” app, which is available on multiple internet-connected devices, including Android mobile, tablet, and TV; iOS mobile and tablet; Amazon’s Echo Show, Kindle Fire tablets, and Fire TV devices; LG TVs powered by webOS; Xbox One game consoles; PlayStation 3 and PlayStation 4; and Samsung’s Tizen Smart TVs. However, Dream4k is not against exploiting alternative distribution channels. Although an original SVOD service, the Dream4k catalog has the potential to be syndicated globally as part of a larger “Dream” brand network. This could see Dream4k content being programmed on third-party TV channels in territories where Dream4k has yet to decide the rollout or its own ambitions for international expansion. In recent years, Dream4k has also developed and promoted user-generated content opportunities in Europe as a means to help develop its “Dream” fan community and tap into viewer-generated content. Creating original, diverse, and exclusive content is the heart, soul, and raison d’être of Dream4k. Market data and consumer insight help guide strategic decision-making. For example, there are digital signposts aimed squarely at emotionally engaging a European viewer base increasingly consumed by tech. Market trends show that the best original movie gems can keep people on board, suggesting potential SVOD subscriber retention targets. Certain types of genre content – sci-fi, documentaries, and romance – may promote someone to subscribe anew. Recent trends also suggest that Dream4k’s differentiator content, such as ballet and real-life horror, resonates across specific European countries. Dream4k’s future programming and audience playing field will evolve over time.

Artificial intelligence improves the operation of the Dream4k television service and makes it different compared to other television networks or streaming services. AI can be applied in different areas of TV service development, particularly for improving content recommendation features, optimizing product operation, and automating associated processes. AI can effectively predict what type of content will be more attractive to an end user. Using past selections, for example, content and genre preferences in combination with current cultural events, trending topics, and more, the AI will be able to tailor suggestions to the user. By using artificial intelligence, the way our users interact with our products has dramatically improved. Content recommendation, as a part of individual user experience, can be a substantial factor that heavily influences the decision to keep the service in a streaming market.

AI can also process different statistics to personalize content delivery and improve the user’s experience. These statistics are based on the massive part of the data that the customer leaves – its reviews on casual websites or via social media. Content recommendation optimization is a very important attribute for any streaming product or media to prevail in a highly competitive environment. AI infrastructure can nowadays act as a key differentiator in the streaming service field. An AI-driven content recommendation system forms a convincing need to maintain and tailor the own user interface and user experience to what they are comfortable with and what they are looking for. Additionally, AI-driven analytics of subscribed movies and TV show actuality can present an interesting topic that can be reviewed against the subscribers’ rate on those topics to further provide content suitable for their consumption rate. In that way, AI can significantly optimize the costs associated with the purchase of broadcasting rights.

12 Future Trends and Predictions for Dream4K Television Service in Europe

With the current trend of 4K/Ultra HD formats starting to enter the European marketplace, a natural progression of television service will be the move from HDTV to Dream4K. The potential for much better image quality and set design delivery will lead to the re-establishment of a world-class television production and hosting service being available in Europe. Prices will already be more than competitive by the time the Dream4K service is available through such visionary thinking and technological developments.

However, one prediction that could affect Dream4K is an increase in technology to provision good quality television through the “On Demand” sector. This is seen as a major profit driver and is still in its early incarnation at this time. There are some fears that this will take over the bulk of new television services, and that many television service companies will give up on television provision altogether and/or sell their delivery technologies to smaller niche suppliers before the end of the next decade. New technologies are able to provide worldwide-based internet services easily at any decided bitrate and could use much less infrastructure than has become commonplace. This type of reception model could be used by many entertainment providers. This is applicable to many different sized content services, including commercial and homegrown. Potential growth is easy using internet technology and through using internet multicasting. Audience trends show a dramatic leap in the reception of media (especially news) on personal computer usage in the last 12 months alone!

We make TV affordable and accessible to everyone, everywhere! With more than 1300 satisfied customers,