In the viewing landscape, traditional cable television services are being faced with a major threat due to a significant breakthrough in technology and implementation of broadband Internet access. Commercial-grade Internet Protocol television (IPTV) services have been launched, and there is commercial availability of IPTV kit and its multi services on the market. It is predicted that in the near future, a great deal of cable television users will change to IPTV users. The number of IPTV subscribers is expected to be almost five billion worldwide in 2010. Dream4k has been cited as a powerful and user-friendly IPTV service provider that offers many features including 15 platforms for viewing one account, the ability to view many different countries thanks to the viewland function, many language choices in VIP USA movie series, 11,000 new movies, and Android and IOS APP support.

Various technologies under the umbrella of IPTV have been enlisted, which include streaming and digital broadcasting. The main features are also discussed that among the multimedia streams, video format support is prominent. It is revealed that European viewers very favor the demand for high-definition (HD) content, and service providers, as the first state, handle channels with more HD resolution. The commercial IPTV providers in Europe are compared, and the profile of Dream4k is presented as a short information owned by London. The IPTV market is very competitive, so IPTV service providers pay a high price for IPTV channels. France and Germany, the two biggest countries in Europe, caused a large increase in prices. Research has been conducted regarding Dream4k, as the company had the advantage of purchasing IPTV channels before October 15, following this increase. Indoor and outdoor marketing were realized, and thus, it was beneficial in terms of acquiring new subscribers. Since October 15, Dream4k has been offering better performance because the IPTV channel prices of the Netherlands, Belgium, and Switzerland suppliers were not changed much (Peoples et al., 2006). This study analyzes the customer engagement and service metrics regarding Dream4k. There is evidence that privacy regulations will follow the GDPR regulation (Xiao et al., 2007). In this sense, Windows application with analysis is also provided. This also provides information to become aware of the consequences for consumers in European countries.

The IPTV industry, like most other video streaming businesses, has been rife with change over the last decade. The adoption of super-fast fibre to the home solutions – increasingly made available to people around Europe with heavily subsidised pricing – has enabled competition from newer technologies such as Dream4k. With these increased internet bandwidths, 4K TV is now possible to receive via IPTV boxes over the internet, giving the picture quality comparisons to match satellite services, attractive to the most demanding of customers. Super-fast broadband streaming services are expected to take over from traditional satellite setups in the years to come (Randal Ray, 2014).

Further technological advancements have seen more and more corporations integrate services into a cloud type shape on the internet – video-on-demand is now becoming popular with IPTV providers with over 1000 titles; whilst virtual personal recorders are enabled by cloud technology allowing users to record multiple streams at once. Alongside this, large data companies now see artificial intelligence as the future for customer service inquiries within IPTV; a chatbot that understands context and learns from your previous message inquiries is now becoming available across multiple consumer services.

Finally, with video streaming technology bettering year on year, there has been a large push towards H.265 whilst still in its infancy due to internet compatibility issues across older and less powerful internet connection boxes within Europe, the codec provides up to 60% better compression than H.264 – or a superior picture at the same low bandwidth of H.264. As the codec becomes more widespread with new IPTV boxes, VOD titles, and streaming systems, picture quality is likely to heavily improve for the end user, synchronizing with the recent picture quality increase from Dream4k. At the same time, the industry has seen a large increase in user interface and streaming box experience; many of the most popular box manufacturers in Europe often don’t specialize in this field – a new box at a similar price-point from Dream4k gave significant user interface improvements and security protection against popular hacking services. Quality OF SERVICE control of an IPTV service is essential in a saturated market; identity theft, loss of service, and data retention have become a big issue with many online-based streaming services in the last decade. In an increasingly competitive market with more aggressive consolidation, it is clear that better quality of service is necessary to stay above opponents; low latency streaming, adaptive streaming methods for VOD, and most newly DreamK offers a unique IP that solely connects to the user’s home network and never shares the user’s IP with any other user, eliminating the connection saturation hacking vulnerability rampant across many internet streaming services has been built into popular boxes and is likely to be a new selling point in the years to come.

At EURO STREAM IPTV, we want to ensure we cover all your favorite devices

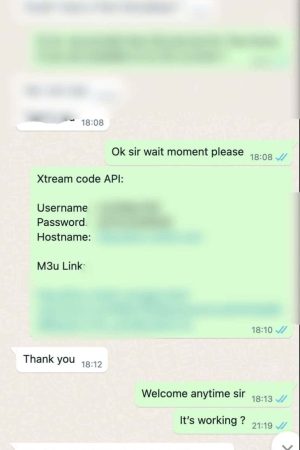

Experience hassle-free IPTV Smarters with our responsive 24/7 customer support. We're always available to ensure you enjoy seamless streaming.

Access premium channels and exclusive events not available anywhere else. Enjoy unique content and entertainment with our IPTV service.

You can easily set up and install your IPTV subscription on your favorite device. If you need assistance, our customer support is here to help you every step of the way.

Current trends in the market for the mentioned industry in the European countries are examined. For this, a literature review and statistical data analysis is assessed to identify the growth pattern of the market and the current market standing of the competitors respectively. A descriptive analysis is also conducted to show the market standing of each country. Demographic factors influencing viewer preferences and their TV consumption habits are examined to infer the future market growth pattern. General market forecasts are also made. A focus is placed on the penetration rate of services among the countries. A descriptive analysis shows the penetration rate of service in the respective countries. The geographic analysis results illustrate that there are substantial variations among European countries for the service.

The market in Europe and its place in it are analyzed. Key players in the industry, their market standing, and their strategies to maintain or increase their market share are discussed. Both economic and cultural factors are examined with a focus on the former, that is, how they have affected consumers to adopt service, and the expected impacts on new entrants in the market in Europe. The anticipated barriers to entry are explored, created in large part by the current dominant local operators. The final discussion reveals that new entrants, who are operating outside of certain countries, are facing huge challenges in Europe, and it suggests that the cooperation of the national government and relevant entities could be an effective means to facilitate the adoption of new technology. A business strategy designed for the newly propositioned operator concludes this section, and is based on the analysis of the current state of the market.

Dream4k offers unique features and IPTV services that set it apart from other European streaming services. These services rely on a user-friendly design with an intuitive interface and personalized recommendation system containing film, series, and sports content relevant to the user’s interests at its core, in addition to seek and watch function. High-quality streaming is equally important to the user base. No matter where they are – on holidays or during bus journeys – it is always handy to have their Balkan, Arabic or Portuguese channels within reach. That is why Dream4k is offering 2, 3, 6 etc., device access options. Offline viewing of selected on-demand content is also possible for subscribers, while a playback functionality is coming soon to the service to enhance the user experience. Service users may select a plan that includes all European, Air or only Balkan, Portugal or Arabic, Spain, Italy, and Turkey. Also, the period of validity may vary depending on their choices and the degree of their film, series and sports interest. Free trials are available to help non-subscribers find their way through the immense library organization more easily. And there is always customer support eagerly awaiting them to inquire or comment on how to make the service even better (Peoples et al., 2006). Furthermore, in case of any technical problem, customer support is just one click away to provide a solution or advice. Some frequently asked questions are already answered and users may also contact Dream4k via email. Apart from ready to help customer support service, there are social networks to use. Users may join one of the Facebook groups to catch the latest updates. They may also follow Dream4k on Instagram to stay up to date. They may search Dream4k on Twitter and have the latest news pop up on the feed. But if the user is less social and would rather direct it with their peers, there is a new users’ forum available (Xiao et al., 2007). Please have in mind that this is just the beginning and there are many wonderful ideas on how the Dream4k community could be expanded.

There are many things that are important to the Dream4k IPTV service and what the customer thinks about it. The client wants to have fast support if there are any problems and the Dream4k support team can answer in less than one hour. The client also needs the Dream4k server to be online 24/7. Dream4k currently has a server that is worse than the competition. Customers report that streams are usually down and that it interrupts watching. This problem needs to be solved. Most clients only want to see content that is worthwhile. The client isn’t interested that there are 10,000 channels if not one is satisfied. What is important to the customer is ease of use. There must be a simple and clear menu. Customers expect that the program will always start. There should be no interruptions. It has been shown in many IPTV consumption studies that the user experience is closely related with quality of the received service (Frnda et al., 2019). The desire to follow on with these studies gave space to this report that should incorporate an evaluation of the Dream4k iptv service. However, the user’s sentiment towards a product could be also uncovered from the amount of text discovered on social media or web pages discussing the product. Social media, and especially recommendations and reviews that paste a whole experience, normally uncover a true sentiment towards the product. When creating a new product, it is important to bear the user requirements in mind. The final usage experience of the product always ranks first, then following services, such as additional equipment service, are settled. The final delivery of the product to the customer should be accompanied by a user manual. If changing the market or modifying its associated rules, the information and communication with the user must change proportionately or be adapted to the new conditions (Karahasanovic & Heim, 2010).

The European entertainment landscape is witnessing the rapid emergence of IPTV, with the delivery of television programs and other video content over a closed, wholly-controlled packet-switched network but only upon payment of subscription fees for this Service. The provider or a third party collocated in the provider’s Facility may control the network. Basic services are typically received off multicast IP streams followed by controlled network access bandwidth. Dream4k is currently dominating the European market for this new service, providing an impressive variety of European, American, and Asian channels to its thousands of satisfied subscribers. However, opportunities to expand its services elsewhere in Europe are currently being impeded due to various regulations, complaints, and even controlled enforcement. Channels from some European countries are often “geo blocked.” This can be annoying for Croatian, Greek speaking viewers, for example, who want to watch German, Italian or UK channels, as it prevents access to all those channels. The reasons for this territorial approach DVR on a single word: licensing.

A major reason why licensing is so complicated is the network of territory-based licensing agreements, which stipulate where and when programs can be sold. This is specially versatile with moving and online sources, Dream4k can properly get all needed licenses for content to its planned service covering all European countries has to purchase licenses from every country. This is further complicated by the likelihood that many of the most desirable sources of content are also the most cautious and hesitant about an to any new, unestablished distribution platforms. This conservative approach can be found at the most recent sector inquiry’s report on the distribution of TV and video on demand services. Re-sales and existing pay TV broadcaster’s EU cannot force its licensee to content to Dream4k as broadcaster’s are essential to Sky UK’s business model. Geo-Glocking can keep out legitimate consumers interested in a wide variety/viewers have complained that they cant get the sports and movies they want to watch most. Geo-blocking allows for broadcasters to price their content more cheaply by avoiding competition from other Member States broadcasters. Geo Glocking is apparently legal and Murdock considers it an essential customer protection policy. It keeps misleading advertising on which segment are actually being related exceptionally broad channel packages and an all or nothing basis (M. Zareh, 2018).

IPTV is a neutral and open platform. Dream4k can approach local either small, innovative players with unique offer which can differentiate themselves by offering IPTV or big, established players that already have the resources for a quick TV offer implementation (Peoples et al., 2006). Dream4k believes that few big TELCOs will be present on all markets and that there is a space in niches (regional or thematic, such us local language or special interests TV channels) where a local IPTV player could be both successful and beneficial for both sides. In such a partnership, technology and knowledge about IPTV transfer from Dream4k side to the partner are planned. Content are more local oriented the IPTV is more interesting to users in a specific region and that the Local content is the sensible subject on which IPTV service should be based, mostly TV channels. While some markets have been more willing to accept IPTV, there has been a great deal of skepticism on the part of operators and analysts about both the overall impact the service will have on the industry and the companies providing it (Fernández-Quijada, 2008). This arises from various reasons, including the unproven business model of some providers, the relatively smooth development of existing television service providers, and the high perceived cost of infrastructure deployment. However, the ultra-wideband network is believed to be the ideal vehicle for delivering on the promise, providing advanced triple play services – high-speed data, voice, and video – to the residential environment. In this space, many vendors are crafting and selling consumer premises equipment capable of easily providing such services.

In term of the Future Trends and Innovation of IPTV services, Dream4k IPTV as one of the most advance providers of IPTV UK anticipate soon a game changer for the industry in UK and across Europe. Since the launch of the IPTV systems, black cables had to link the box to the internet hub, then the aerial is also in the same room that means often quite hard and long wire passing through the house, now new chips and aerial and even for DVB-T, existing HDMI channels will broadcast the wifi instead of wired. Main phone manufacturers are to launch their next phone 11 equipped with 5G connectivity (Tsekleves et al., 2009). High quality live stream is possible without buffering and 4K quality will be ready, thus providers are asked to furnish 4K streams.

Another innovation to come soon is augmented reality. The goal is to add stories games to real-world through a mobile phone and smartglasses, the blending of the real world and the virtual world is already happening mainly on mobile, now the connect your phone story sharing and gamification will be developed on smartglasses. The city of London has select and fund a company to develop a platform that connects movie and TV series and corresponding London locations to be able to explore them. Soon other cities will propose it and this fun hunting of the city will also be one of the trends, being able to share or stream this movie directly on devices connecting to the internet is also a game changer. Being able to discover a new program by test watching it will also be developed. Spin the wheel of fun or luck or style shows will be present and active.

Personalized and interactive viewing is also a focus point of the future. A consumer entering a room and the parental control blocks the access to the politically oriented TV program, the automatic preference of next episode of the series watched or the automatic broadcasting record of all the issues that a public figure is invited in. 90% of content consumption within 4 years is going to be personal to the preferences shared. Polls, reminders, trivia during live sport games, similar stories shows, and the hashtag of the TV program to be written in the message will also be developed.

This paper presented an overview describing steps taken in a strategic foresight study of IPTV technologies. Dream4k is an established provider of IPTV services in Europe, the industry’s main challenges were identified and analyzed, foresight was used to formulate scenarios of possible future service solutions, and an experimental service solution was implemented as a trial. The implementation of the trial service is described, its performance evaluated and insights for potential future service solutions discussed. A main contribution is a review of challenges and feasibility issues in providing innovative services and a discussion of necessary steps in simplifying the implementation of the trials. The experimental trial service was considered successful in bridging the know-how of the provider and the operator and in providing a continuous learning process that allows both actors to understand the business requirements for innovative services, speeding up development processes accordingly (Peoples et al., 2006). Since 1998 Dream4k has been providing video services to households in Finland using the DVB-C technology. Dream4k has been part of the Finnet Group since 2003. The existing service platform utilizes technology deployed in the end of the nineties but the offering of video services has developed constantly and the amount of digital service subscribers is rapidly increasing. The evolving local competition as well as national and international players and future enhanced TV delivery channels have driven Dream4k to investigate various delivery platforms and search for technologies to maintain and enhance the competitiveness of its video services. During the process different IPTV solutions were analyzed in view of cost and complexity issues, and an IP multicast based solution was favored. In addition to the technology study the business environment was studied regarding regulatory restrictions, consumer expectations, and competitive landscape. The paper gives recommendations for service providers of how to anticipate market orientation of, and changes in legislation regulating, up-coming streamed content delivery markets (Magalhães et al., 2012).

References:

Peoples, C., Dini, P., McClean, S., Parr, G., & Black, M., 2006. Bringing IPTV to the Market through Differentiated Service Provisioning. [PDF]

Xiao, Y., Du, X., & Zhang, J., 2007. Internet protocol television (IPTV): The Killer application for the next-generation internet. [PDF]

Randal Ray, T., 2014. Improved IPTV channel change times through multicast caching of pre-selected channels. [PDF]

Frnda, J., Nedoma, J., Vaňuš, J., & Martinek, R., 2019. A hybrid QoS-QoE estimation system for IPTV service. [PDF]

Karahasanovic, A. & Heim, J., 2010. Understanding users of web-TV. [PDF]

Fernández-Quijada, D., 2008. Un estándar para múltiples modelos : la experiencia europea en la transición a la TDT. [PDF]

Tsekleves, E., Cosmas, J., Aggoun, A., & Loo, J., 2009. Converged digital TV services: The role of middleware and future directions of interactive television. [PDF]